Probiotic Infant Formula Market Size to Exceed USD 3,071.58 Million by 2034 | Towards FnB

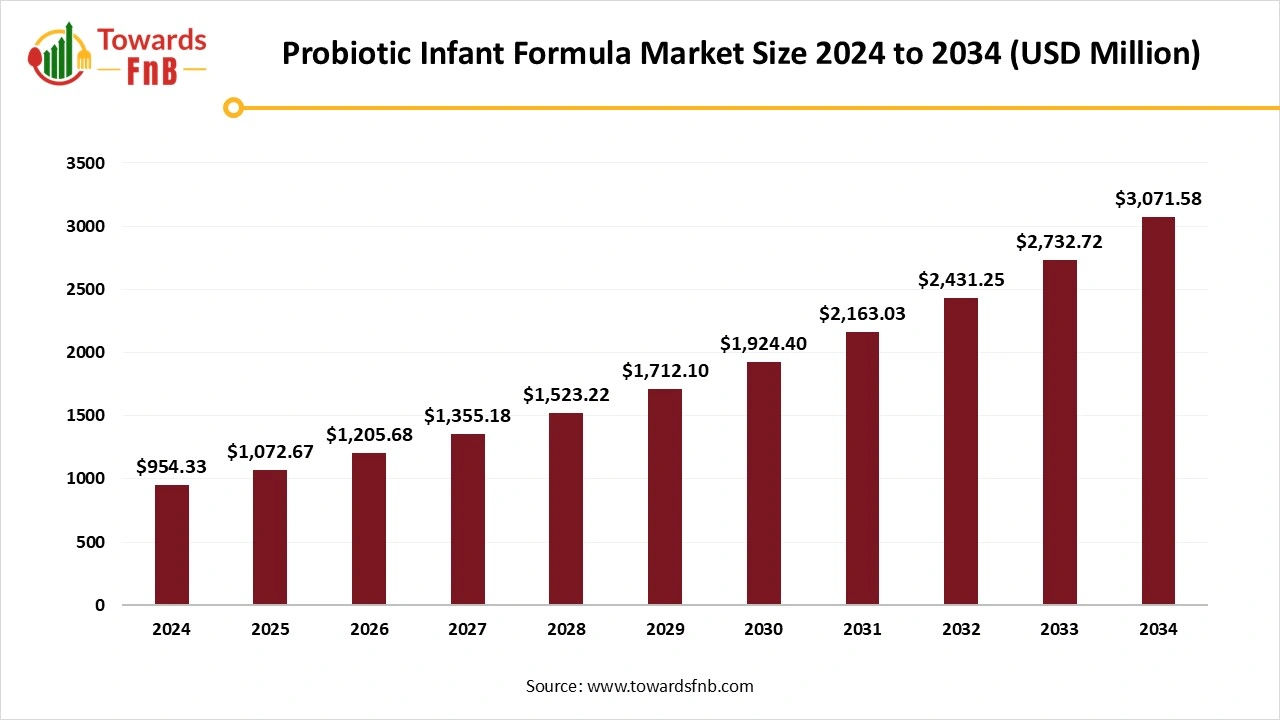

According to Towards FnB, the global probiotic infant formula market size is calculated at USD 1,072.67 million in 2025 and is expected to reach USD 3,071.58 million by 2034, reflecting at an impressive CAGR of 12.4% from 2025 to 2034. This rapid growth highlights the increasing adoption of probiotic-based formulations among infant nutrition brands as parents and healthcare professionals increasingly recognize the importance of gut health in early childhood development.

Ottawa, Oct. 22, 2025 (GLOBE NEWSWIRE) -- The global probiotic infant formula market size stood at USD 954.33 million in 2024 with a forecasted growth trajectory from USD 1,072.67 million in 2025 to USD 3,071.58 million by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is experiencing growth due to rising digestive problems among infants, improved gut health in infants, and higher demand for probiotics to enhance infant gut health and improve digestion.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5870

Key Highlights of the Probiotic Infant Formula Market

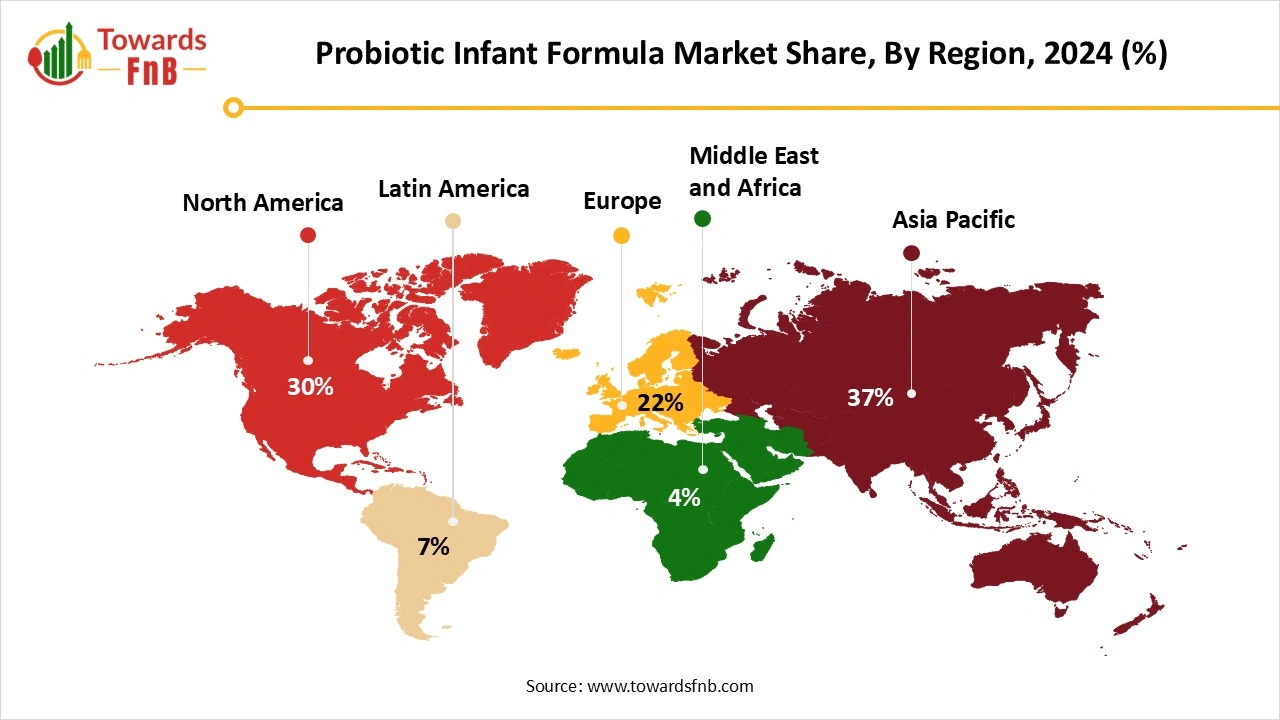

- By region, Asia Pacific led the probiotic infant formula market with highest share of 37% in 2024, whereas North America is expected to grow in the foreseeable period.

- By age group, the infant segment captured the maximum share of 70% in 2024, whereas the toddlers segment is expected to grow in the foreseeable period.

- By ingredient, the Bifidobacterium segment led the market with largest share of 45% in 2024, whereas the Lactobacillus segment is observed to be the fastest growing in the foreseen period.

- By formulation, the powdered formula segment led the market with largest share of 60% in 2024, whereas the ready-to-feed segment is expected to grow in the expected timeframe.

- By distribution channel, the offline segment captured the maximum share of 80% in 2024, whereas the online segment is expected to grow in the foreseeable period.

Product Innovation Helping the Growth of Probiotic Infant Formula

The probiotic infant formula market is observing growth due to rising health consciousness among parents for infant health, changing lifestyles, and the growing population of working mothers. Product innovation, helpful to introduce more nutritional elements in infant formula for improved and healthy digestion, is another major factor for the growth of the market. Availability of ready-to-eat and ready-to-feed infant formula in convenient packaging further fuels the growth of the market for probiotic infant formula, as it can be easily carried while traveling outdoors to allow parents to feed the child easily.

New Trends of the Probiotic Infant Formula Market

- Personalization and customization to fulfill the needs of an infant as per the requirements help the growth of the probiotic infant formula market.

- Demand for plant-based and organic infant formulas also helps to fuel the growth of the market.

-

Higher demand for clean-label products also helps the growth of the market.

According to Vidyesh Swar, Principal Consultant at Towards FnB, “Multi-strain and synbiotic formulations are expanding faster than single-strain products, driven by clinical validation, transparent labeling, and increased parental awareness of gut health benefits. Manufacturers are introducing more organic-certified, sustainable, and HMO-enriched products to strengthen consumer trust globally.”

Innovation in Probiotic Infant Formula

- Synbiotics- the segment involves the amalgamation of prebiotics and probiotics for infants, like HMOs, to support the infants’ gut microbiome. Another aim of the market is to mirror the nutrients of a mother’s milk for infants.

- Age-Specific Formulas- the companies are focusing on the manufacturing of infant formulas to adjust the nutritional elements mirroring the breast milk as per the infant’s age.

- Targeted Probiotic Strains- Research is helping companies to support and include specific probiotic strains in the formula, such as Bifidobacterium longum subsp. That helps to support the development of infants.

- Improved Delivery and Convenience- companies are focusing on providing nutritional products for growing infants as well as the mothers for their postpartum stage, and allowing them to consume the required nutrition for their bodies.

Impact of AI in the Probiotic Infant Formula Market

Artificial intelligence (AI) is profoundly transforming the probiotic infant formula market by driving innovation, enhancing quality control, and supporting personalized nutrition. In research and development, AI-powered algorithms analyze large datasets from microbiome research, clinical studies, and infant health data to identify optimal probiotic strains that promote gut health, immunity, and overall development. Machine learning models simulate the interaction between probiotic strains and infant microbiota, helping manufacturers design formulas that are both safe and effective for specific age groups or health conditions, such as colic or lactose sensitivity.

In manufacturing, AI-driven predictive analytics optimize fermentation and formulation processes, ensuring consistent probiotic viability and potency throughout production and storage. Computer vision and AI-enabled sensors strengthen quality control by detecting contamination, verifying bacterial counts, and ensuring product stability, key factors in maintaining efficacy and safety. AI also assists in developing next-generation probiotic blends by predicting synergistic effects between different strains and nutritional ingredients, reducing R&D time and cost.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/probiotic-infant-formula-market

Recent Developments of the Probiotic Infant Formula Market

- In October 2025, industry research firm Innova Market Insights reported that 57% of infant formula products launched in 2025 included the prebiotic galacto-oligosaccharides (GOS), signaling a strong shift within the probiotic infant formula sector toward gut-health-focused ingredients that support beneficial microbiota in early life. (Source: https://www.nutraingredients.com)

- In February 2025, A2 Milk Company announced the launch of its A2 Genesis infant formula in Mainland China by late FY25. The formula includes three key HMOs along with prebiotics and probiotics, and DHA. (Source- https://www.trendhunter.com)

Trade Analysis of the Probiotic Infant Formula Market: Import & Export Statistics

- New Zealand: The island country is one of the largest global exporters of infant formula, particularly to Asian markets such as China and Southeast Asia. Its reputation for high-quality dairy production, strict safety standards, and trusted product origins has strengthened demand for New Zealand-made probiotic and specialty infant formulas.

- European Union: Europe remains a major export hub for probiotic infant formula, driven by established dairy industries, advanced R&D capabilities, and stringent quality regulations. European exporters also act as contract manufacturers for multinational nutrition companies, supplying probiotic-fortified formulas to regions including Asia, the Middle East, and Latin America.

- United States: The U.S. exports premium probiotic infant formulas and probiotic ingredients to multiple regions, benefiting from strong innovation, established probiotic suppliers, and growing brand recognition. American manufacturers focus on patented probiotic strains and functional formulations aimed at immune and digestive health.

- Asia-Pacific Producers: China, Thailand, and Australia serve as growing production and export centers for probiotic and specialty infant formulas. China’s large-scale manufacturing capacity, combined with government support for domestic innovation, allows it to export both finished products and probiotic ingredients to emerging markets across Asia and Africa.

Top Importers and Demand Centers

China: China remains the single largest importer of infant formula globally, driven by its sizable infant population and consumer preference for imported, high-quality, and trusted brands. The country’s post-pandemic reopening and easing of import regulations have reignited demand for probiotic and premium infant formulas from New Zealand, Europe, and the U.S.

Southeast Asia and the Middle East: Markets such as Vietnam, Indonesia, Saudi Arabia, and the United Arab Emirates are rapidly expanding their imports of probiotic infant formula. Rising incomes, urbanization, and increased awareness of infant nutrition contribute to this steady growth in demand.

North America and Europe: While these regions are primarily production hubs, they also import specialized probiotic strains and value-added formulations for domestic repackaging or further processing.

Country / Regional Highlights and Trade Flows

- New Zealand to China and Asia: New Zealand continues to dominate exports to China and other Asian markets, leveraging its strong dairy sector, traceability standards, and brand credibility.

- Europe to Global Markets: The Netherlands, Germany, and Ireland serve as leading exporters, supplying both branded and private-label probiotic formulas to global distributors and retailers.

- U.S. to Asia-Pacific: American exporters focus on supplying probiotic-enriched formulas and probiotic ingredient blends to emerging Asian markets, where demand for functional and premium infant nutrition is rising.

- Asia as Dual Producer and Importer: China and Thailand are expanding manufacturing of probiotic formulas while also importing specialized probiotic ingredients from Europe and North America to support domestic production.

Probiotic Infant Formula Market Dynamics

What Are the Growth Drivers of the Probiotic Infant Formula Market?

The probiotic infant formula market is observed to be growing due to multiple factors, such as the growing population of working mothers, rapid urbanization, changing lifestyles of consumers, and various other similar factors. Infant formulas have essential bacteria helpful to keep the gut of infants healthy and also help to strengthen their immunity. Hence, such factors further help to fuel the growth of the market. Higher demand for ready-to-eat and ready-to-feed infant formulas allows working mothers to save time and feed their child conveniently, further helping the growth of the market. Availability of different types of infant formulas on different distribution channels also helps to fuel the growth of the market.

Challenge

How are Regulatory Hurdles Hampering the Growth of the Market?

Regulatory hurdles may slow the growth of the probiotic infant formula market. There are different global and local regulations for the production of infant formula, and there are different rules for their trading as well. Hence, it creates issues in the exportation of such products internationally. It also creates issues for healthcare providers and caregivers due to the insufficiency of stock. Hence, such issues may obstruct the growth of the market for probiotic infant formula.

Opportunity

How Have Product Innovations Been Helpful for the Growth of the Probiotic Infant Formula Sector?

Innovation in infant formula in the form of its elevated nutritional profile, palatable flavors, improved formulation of easy digestion, strengthened immunity, and other supportive factors aids the growth of the market. Availability of such products online and in stores further fuels the growth of the probiotic infant formula market. Specialized infant formulas with added nutrients further fuel the growth of the market.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5870

Probiotic Infant Formula Market Regional Analysis

Asia Pacific Led the Probiotic Infant Formula Market in 2024

Asia Pacific led the probiotic infant formula market in 2024 due to higher demand for natural and organic infant formulas in the region to maintain the safety and nutrition of infants. Growing population, rapid urbanization, growing population of working mothers, and changing lifestyles of consumers are other major factors for the growth of the probiotic infant formula sector. Countries such as India, China, Japan, and South Korea have made major contributions to the growth of the market in the region. Growing health consciousness among parents for their infant’s health is another major factor for the growth of the market.

North America is Observed to Be the Fastest-Growing Region in the Foreseeable Period

North America is observed to be the fastest-growing region in the foreseen period due to higher demand for ready-to-eat and ready-to-feed formulas, which are helpful for the growth of the probiotic infant formula market in the foreseen period. Changing consumer lifestyles, a growing population of working mothers, increasing government regulations, and supportive initiatives further aid the growth of the market. The US and Canada will make a major contribution to the growth of the probiotic infant formula market in the foreseeable period.

Probiotic Infant Formula Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 12.4% |

| Market Size in 2025 | USD 1,072.67 Million |

| Market Size in 2026 | USD 1,205.68 Million |

| Market Size by 2034 | USD 3,071.58 Million |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Probiotic Infant Formula Market Segmental Analysis

Age Group Analysis

The infants (0-3 months) segment led the probiotic infant formula market in 2024 due to rapid urbanization, growing population of working mothers, and higher demand for formulas trusted by pediatricians and hospitals for the complete safety of an infant’s diet. The rising birth rate of developing nations is another major factor for the growth of the probiotic infant formula market. The infant milk formula is another safe option, further fueling the growth of the market. Such products are tested and then introduced in the market for the complete safety of a child and to allow parents to trust the product for its use.

The toddlers segment (1-3 years) is expected to grow in the foreseen period as the product has multiple health benefits for toddlers, such as supporting elements for toddlers, having useful bacteria for toddlers’ gut microbiome, and being helpful to support the digestive system of toddlers. The segment also plays a vital role in the growth of markets, as such products are essential for toddlers to keep them safe from any kind of antibiotic-related infectious diarrhea, improve iron absorption, support weight gain, and other beneficial factors.

Ingredient Analysis

The Bifidobacterium segment led the probiotic infant formula market in 2024, as it helps to enhance the gut microbiome of infants and toddlers, which is helpful for their easy digestion and improved gut lining. The segment also enhances other beneficial factors for infants, such as protection from metabolic disorders, obesity, and diarrhea, and is also helpful in improving digestion. The segment also helps to establish essential gut microbiota for improved digestion in infants. The bacteria also help to reduce inflammation in early life, improve immunity responses, further leading to enhanced immunity, further fueling the segment’s growth as well.

The lactobacillus segment is observed to grow in the foreseen period, as the bacteria, when used in the preparation of infant formula, help to lower the chances of diseases such as diarrhea, infections, and colic by strengthening the immune system, which is helpful for the growth of the probiotic infant formula market. The bacteria also help to improve the gut barrier of infants and lower the chances of pathogen attack. The bacteria help to maintain gut health and develop essential gut bacteria. The bacteria help to lower the gut infection and also help to keep the infants safe from commonly observed digestive issues such as colic and diarrhea.

Formulation Analysis

The powdered formula segment led the probiotic infant formula market in 2024 due to its longer shelf life, improved formula, ease of carrying, and cost-effectiveness. Such factors help to fuel the growth of the market. The powdered formula allows parents to mix an adequate amount of formula with water and feed to an infant for a healthy gut with complete nutrition. The market also observed growth as the proper usage of the product provides viability, cost-effectiveness, and is also helpful to maintain the freshness of the product.

The ready-to-feed segment is expected to grow in the foreseen period due to enhanced convenience, a growing population of working mothers, and higher demand for nutritious and convenient options, which is helpful for the growth of the probiotic infant formula market in the foreseen period. Increasing disposable income and urbanization are other major factors for the growth of the market. The market also observes growth due to higher demand for safe and nutritious products that help to strengthen the digestive system and immunity of infants.

Distribution Channel Analysis

The offline segment led the probiotic infant formula market in 2024, as the availability of different types of nutritious infant formulas in supermarkets and hypermarkets makes it easy for parents to buy the right product. Such stores have different types of infant formulas in stock, depending on the age of the child, to get the right product with the right nutritional elements. Such stores have a separate section with products stacked conveniently for parents to allow them to shop for the right products and get detailed information about them as well.

The online segment is observed to be the fastest growing in the foreseen period due to convenience, the growing population of working mothers, and cost-effectiveness as well. The online segment allows parents to read the product details and order the right product as per their infant’s requirements. Different types of formulas available in different flavor options also help the growth of the probiotic infant formula market in the foreseeable period. The parents can also glance through the reviews of the product posted by other consumers for detailed information.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Fresh Produce Market: The global fresh produce market size is projected to grow from USD 3,707 billion in 2025 to approximately USD 5,653 billion by 2034. This anticipated growth represents a CAGR of 4.80% during the forecast period from 2025 to 2034.

Top Companies in the Probiotic Infant Formula Market and Their Strategic Developments

- Reckitt Benckiser Group: Reckitt Benckiser, through its brand Enfamil, is a global leader in probiotic infant formula, offering formulations designed to support digestive health and immune development. The company integrates clinically studied probiotic strains such as Lactobacillus rhamnosus GG to promote gut microbiota balance. Reckitt continues to invest in research-backed nutrition solutions for infant growth and wellness.

- HiPP: HiPP is a leading European producer of organic infant formula enriched with probiotics and prebiotics. Its formulas combine Lactobacillus fermentum and dietary fibers to support gut flora development and natural immunity. HiPP’s commitment to organic sourcing and gentle processing ensures high-quality, safe nutrition for infants.

- FrieslandCampina: FrieslandCampina offers premium infant nutrition under brands such as Friso, incorporating probiotics to enhance gut health and nutrient absorption. The company focuses on clinically validated ingredients and sustainable dairy sourcing to meet global infant nutrition standards.

- Mead Johnson Nutrition: Mead Johnson, part of Reckitt, produces advanced probiotic and prebiotic-enriched infant formulas under brands like Enfamil NeuroPro. Its products are designed to mimic human milk composition, supporting cognitive and immune development in infants.

- Arla Foods: Arla Foods develops infant formulas fortified with probiotics derived from its proprietary dairy strains. The company’s focus on natural ingredients and scientific innovation supports infant gut health and nutrient uptake.

- Yili Group: Yili Group is a major Chinese dairy company offering probiotic infant formulas with scientifically selected strains to enhance digestive comfort and immunity. Its investments in R&D and nutritional science have strengthened its leadership in Asia’s infant formula market.

- Beingmate: Beingmate produces probiotic-enhanced infant formulas designed to promote gut microbiota balance and nutrient absorption. The company collaborates with research institutions to develop evidence-based nutritional formulations.

- Feihe International: Feihe International specializes in premium infant formulas incorporating probiotics and prebiotics to improve digestive function and strengthen the immune system. Its focus on localized R&D and high-quality raw materials ensures product safety and efficacy.

- Synlait Milk: Synlait Milk manufactures probiotic-enriched infant formula ingredients for global brands, emphasizing quality and traceability. Its partnerships with leading nutrition companies support customized, science-backed formulations for infant health.

- Fonterra Co-operative Group: Fonterra is a global dairy leader providing probiotic ingredients such as Lactobacillus rhamnosus HN001 for infant formulas. Its research in gut health and immune function underpins the success of many global infant nutrition brands.

- Bellamy’s Organic: Bellamy’s Organic offers certified organic infant formulas fortified with probiotics and prebiotics to support natural digestion. The company’s emphasis on purity and sustainability appeals to health-conscious parents seeking clean-label nutrition.

- Nutricia (Danone): Nutricia, a subsidiary of Danone, develops advanced probiotic infant formulas under brands like Aptamil and Nutrilon. Its patented Bifidobacterium breve and Lactobacillus strains support healthy gut flora and immune maturation in early life.

- Nestlé Good Start: Nestlé’s Good Start line features probiotic-enriched infant formulas formulated with L. reuteri, clinically proven to support digestion and reduce colic. The brand leverages Nestlé’s global expertise in early-life nutrition and gut health research.

- Custom Probiotics Inc.: Custom Probiotics provides high-potency probiotic blends used in dietary supplements and infant formula manufacturing. Its formulations are tailored to enhance gastrointestinal health and immune support from infancy onward.

- SFI Health: SFI Health produces probiotic formulations designed for digestive and immune support, supplying ingredients for pediatric and infant nutrition markets. Its clinically researched strains support microbiome balance and gastrointestinal resilience.

- i-Health Inc.: i-Health, a division of DSM-Firmenich, develops probiotic-based health products, including those formulated for infants. Its Culturelle brand is globally recognized for its Lactobacillus rhamnosus GG strain, promoting digestive comfort and immune protection in children.

-

Lifeway Foods: Lifeway Foods offers probiotic dairy and non-dairy products, leveraging its expertise in fermentation for gut-friendly nutrition. The company’s focus on microbiome health positions it as a growing player in the pediatric probiotic nutrition segment.

Segments Covered in the Report

By Age Group

- Premature Infants

- Infants (0–12 months)

- Toddlers (1–3 years)

By Ingredient Type

- Lactobacillus

- Bifidobacterium

- Streptococcus

- Others (Bacillus, Saccharomyces)

By Formulation Type

- Powdered Formula

- Liquid Concentrate

- Ready-to-Feed

By Distribution Channel

- Online

- Offline

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5870

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse |

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Dietary Supplements Market: https://www.towardsfnb.com/insights/dietary-supplements-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.