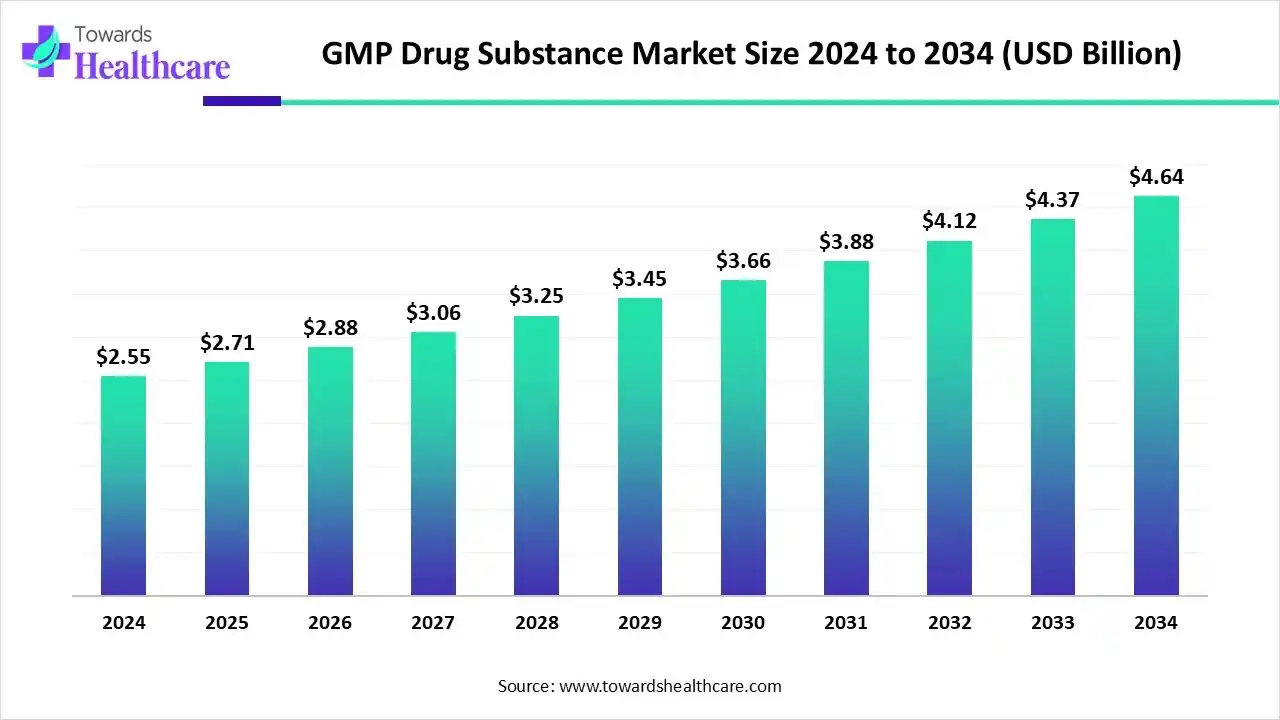

GMP Drug Substance Market to Reach USD 4.64 Billion by 2034, Growing at 6.14% CAGR

The global GMP drug substance market size is calculated at USD 2.71 billion in 2025 and is expected to reach around USD 4.64 billion by 2034, growing at a CAGR of 6.14% for the forecasted period.

Ottawa, Nov. 21, 2025 (GLOBE NEWSWIRE) -- The global GMP drug substance market size was valued at USD 2.55 billion in 2024 and is predicted to hit around USD 4.64 billion by 2034, rising at a 6.14% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research. The global GMP drug substance market is driven by the increasing diseases and growing innovations.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6311

Key Takeaways

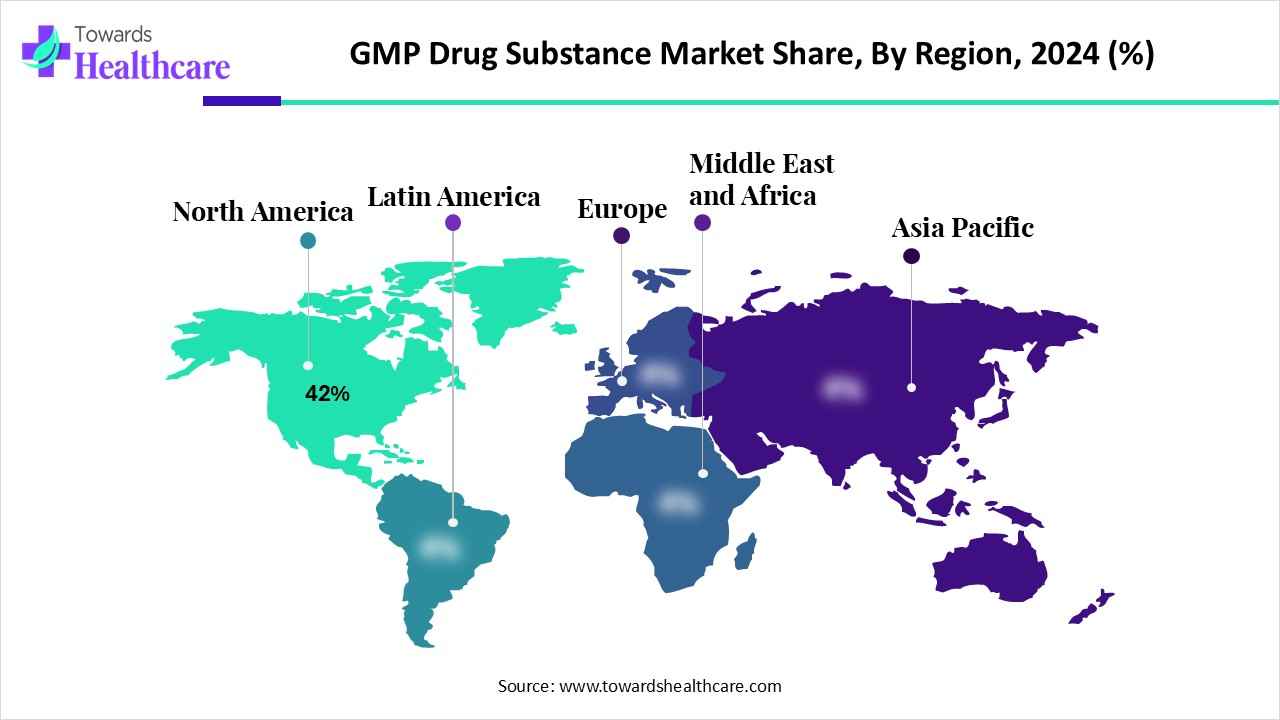

- North America held a major revenue of approximately 42% share of the market in 2024.

- Asia-Pacific is expected to witness the fastest growth in the GMP drug substance market during the forecast period.

- By modality/drug substance type, the small-molecule APIs segment held a major revenue of approximately 52% share of the market in 2024.

- By modality/drug substance type, the viral vectors & other cell/gene therapy drug substances segment is expected to witness the fastest growth in the market during the forecast period.

- By manufacturing platform/process type, the chemical synthesis segment held a major revenue of approximately 42% share of the market in 2024.

- By manufacturing platform/process type, the viral-vector upstream/downstream platforms segment is expected to witness the fastest growth in the market during the forecast period.

- By scale/use case, the commercial-scale manufacturing segment held a major revenue of approximately 58% share of the market in 2024.

- By scale/use case, the clinical-scale (phase I-III) & tech transfer segment is expected to witness the fastest growth in the market during the forecast period.

- By end user/buyer type, the large pharmaceutical companies segment held a major revenue of approximately 48% share of the market in 2024.

- By end user/buyer type, the biotech/emerging developers segment is expected to witness the fastest growth with approximately 26% share in the market during the forecast period.

Quick Facts Table

| Table | Scope | |

| Market Size in 2025 | USD 2.71 Billion | |

| Projected Market Size in 2034 | USD 4.64 Billion | |

| CAGR (2025 - 2034) | 6.14 | % |

| Leading Region | North America by 42% | |

| Market Segmentation | By Modality/Drug Substance Type, By Manufacturing Platform/Process Type, By Scale/Use Case, By End User/Buyer Type, By Region | |

| Top Key Players | Lonza Group, Samsung Biologics, WuXi Biologics / WuXi AppTec, Catalent, Inc., Thermo Fisher Scientific / Patheon, Fujifilm Diosynth Biotechnologies, Boehringer Ingelheim BioXcellence, Rentschler Biopharma, AGC Biologics, Novasep, Cambrex Corporation, Evonik (Custom Pharma & Biotech Services), Patheon (Thermo group), Jubilant Life Sciences / Jubilant HollisterStier, Siege/ Siegfried (API & finished dosage CDMO), PCI Pharma Services / Alcam, SK Pharmteco / Samyang / Dongkwang, Lonza-scale smaller players & regional CMOs, Specialist viral vector CDMOs (multiple fast-scaling firms), Peptide specialists & oligo CDMOs | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What is the GMP Drug Substance?

The GMP drug substance market is driven by growing demand for small molecule generics and complex biologics. The GMP drug substance refers to the active pharmaceutical ingredients (API) or biologically active components developed in compliance with the Good Manufacturing Practice (GMP) standards to ensure their safety, quality, and consistency.

What are the Major Growth Drivers in the GMP Drug Substance Market?

The growing use of advanced modalities is the major driver in the market. To deal with the growing chronic diseases, the demand for biologics or cell and gene therapies is increasing, driving the demand for specialized GMP manufacturing platforms. Additionally, the expanding pipeline, outsourcing trends, stringent regulations, and technological advancements are other market drivers.

What are the Key Drifts in the GMP Drug Substance Market?

The market has been expanding due to the growing investments and collaborations to launch and enhance the use of various GMP drug substances.

- In November 2025, a total of $3.1 million share of a Gates Foundation Global Grand Challenge grant was awarded for the low-cost monoclonal antibody (mAb) manufacturing to Professor Todd Przybycien, Ph.D., head of RPI’s Department of Chemical and Biological Engineering.

- In October 2025, a majority investment by Curewell Capital was announced by Wilmington PharmaTech, where this collaboration will help to expand and scale Wilmington PharmaTech’s manufacturing capacity

and the production of small molecule API in the U.S., respectively.

What is the Significant Challenge in the GMP Drug Substance Market?

High manufacturing costs act as a major challenge in the market. They require expensive equipment, raw materials, skilled personnel, and specialized facilities, which adds to the cost, making the manufacturing process expensive. Moreover, supply chain complexities, strict regulatory compliance, technical complexities, and capacity limitations are other maker restraints.

Rapid Expansion of Biologics, Vaccines, And Cell & Gene Therapies Creates a High Demand For GMP-Grade APIs

| Date | Company | Launch | Category |

| Sep 2024 | Flash BioSolutions | Initiated GMP production of FlashRNA technology for next-generation mRNA vaccines and therapies. | mRNA Vaccine Technology |

| Jul 2025 | Aragen Biotechnologies | Commenced GMP manufacturing at Bangalore facility using an intensified fed-batch platform (>25 g/L). | Biologics Manufacturing |

| Aug 2025 | WuXi Biologics | Received EMA approval for commercial manufacturing of an innovative biologic at the Dundalk, Ireland site. | Biologics Manufacturing |

| Mar 2025 | Syngene International | Acquired a U.S. biologics facility in Baltimore, enhancing large molecule manufacturing capacity | Biologics Manufacturing |

| Jul 2025 | AGC Biologics | Entered partnership with Valneva SE to supply GMP drug substance for the tetravalent Shigella vaccine. | Vaccine Manufacturing |

| Aug 2025 | Bharat Biotech | Launched oral cholera vaccine, Hillchol, following successful Phase 3 trials; aims for 200 million doses annually. | Vaccine Manufacturing |

| May 2024 | ImmunityBio | Completed GMP drug substance manufacturing sufficient for 170,000 doses of ANKTIVA (nogapendekin alfa inbakicept-pmln). | Cell & Gene Therapy |

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Regional Analysis

Why did North America Dominate the GMP Drug Substance Market in 2024?

In 2024, North America captured the biggest revenue share of 42% in the market, driven by the presence of advanced industries, with developed GMP manufacturing infrastructure. The growing R&D practices and clinical trials have also increased their use. The growing healthcare investments and expanding CDMO facilities also provided GMP facilities, promoting the outsourcing trends. The stringent regulations also ensured compliance with the GMP standards, where these advancements contributed to the market growth.

What Made the Asia Pacific Grow Rapidly in the GMP Drug Substance Market in 2024?

Asia Pacific is expected to host the fastest growth in the market during the forecast period, due to the expanding industries, where the growing investments are further supporting the expansion of the manufacturing capacities. The growing patient population and R&D are increasing the production rates of the GMP drug substances and their innovations. The government support and affordable production are also promoting the generic drug manufacturing in compliance with the regulatory standards, enhancing the market growth.

Segmental Insights

By modality/drug substance type analysis

Why Did the Small-Molecule APIs Segment Dominate in the GMP Drug Substance Market in 2024?

By modality/drug substance type, the small-molecule APIs segment led the market with approximately 52% share in 2024, due to their established manufacturing infrastructure. They consisted of lower production costs and high scalability. Additionally, their increased use in various diseases also increased their GMP practices.

By modality/drug substance type, the viral vectors & other cell/gene therapy drug substances segment is expected to show the highest growth during the upcoming years, driven by their increasing pipeline. Moreover, the funding and investments are also encouraging their R&D, which is increasing the demand for GMP facilities.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By manufacturing platform/process type analysis

Which Manufacturing Platform/Process Type Segment Held the Dominating Share of the GMP Drug Substance Market in 2024?

By manufacturing platform/process type, the chemical synthesis segment held the dominating share of approximately 42% in the market in 2024, driven by its affordability. This increased their use in the synthesis of small molecules, biologics, and advanced modalities. Their high-volume production capacity also promoted their use.

By manufacturing platform/process type, the viral-vector upstream/downstream platforms segment is expected to show the fastest growth rate during the upcoming years, due to their expanding gene therapy pipelines. Moreover, the increasing approvals and investments are also increasing their use.

By scale/use case analysis

What Made Commercial-Scale Manufacturing the Dominant Segment in the GMP Drug Substance Market in 2024?

By scale/use case, the commercial-scale manufacturing segment led the market with approximately 58% share in 2024, driven by its established product portfolios. Additionally, their consistent manufacturing process increased their use in the development of various generic products.

By scale/use case, the clinical-scale (phase I-III) & tech transfer segment is expected to show the highest growth during the predicted time, due to growing R&D activities. The growing outsourcing trends and development of advanced modalities have also increased their use, leading to new collaborations among companies.

By end user/buyer type analysis

How the Large Pharmaceutical Companies Segment Dominated the GMP Drug Substance Market in 2024?

By end user/buyer type, the large pharmaceutical companies segment held the dominating share of approximately 48% in the market in 2024, due to their high production volumes. Moreover, they also consisted of large drug portfolios with continuous R&D activities, which ensured compliance with the GMP standards.

By end user/buyer type, the biotech/emerging developers segment is expected to show the fastest growth rate, with approximately 26% share in the market during the predicted time, driven by growing innovations. Additionally, the growing investments, funding, and outsourcing trends are increasing the demand for GMP supplies.

Browse More Insights of Towards Healthcare:

The global controlled substance market size marked US$ 93.7 billion in 2024 and is forecast to experience consistent growth, reaching US$ 98.71 billion in 2025 and US$ 157.7 billion by 2034 at a CAGR of 5.35%.

The U.S. Controlled Substance Market size is estimated at US$ 52.3 billion in 2024, is projected to grow to US$ 55 billion in 2025, and is expected to reach around US$ 84.95 billion by 2034. The market is projected to expand at a CAGR of 5.24% between 2025 and 2034.

The global GMP peptides market size is calculated at USD 1.3 billion in 2024, grew to USD 1.41 billion in 2025, and is projected to reach around USD 2.9 billion by 2034. The market is expanding at a CAGR of 8.35% between 2025 and 2034.

The global GMP plasmid DNA manufacturing market size is calculated at USD 250 in 2024, grew to USD 273.35 million in 2025, and is projected to reach around USD 608.57 million by 2034. The market is expanding at a CAGR of 9.34% between 2025 and 2034.

The global GMP grade cytokines market size is calculated at USD 2.54 billion in 2024, grew to USD 2.79 billion in 2025, and is projected to reach around USD 6.48 billion by 2034. The market is expanding at a CAGR of 9.84% between 2025 and 2034.

Recent Developments in the GMP Drug Substance Market

- In November 2025, to ensure strict compliance with the good manufacturing practices (GMP) as per the revised Schedule M norms, an inspection will be conducted at pharmaceutical manufacturing units, as per the announcement by the Drugs Controller General of India (DCGI).

- In November 2025, Nucelion Therapeutics, a wholly owned subsidiary positioned as a Contract Research, Development and Manufacturing Organisation (CRDMO), was launched by Bharat Biotech International Ltd, which consists of state-of-the-art GMP facilities for the development of autologous and allogeneic cell therapies, plasmids, viral and non-viral vectors.

GMP Drug Substance Market Key Players List

- WuXi Biologics/WuXi AppTec

- Lonza Group

- Catalent, Inc.

- Samsung Biologics

- Boehringer Ingelheim BioXcellence

- Thermo Fisher Scientific/Patheon

- Rentschler Biopharma

- Fujifilm Diosynth Biotechnologies

- Cambrex Corporation

- AGC Biologics

- Evonik (Custom Pharma & Biotech Services)

- Novasep

- Siege/Siegfried (API & finished dosage CDMO)

- Patheon (Thermo group)

- PCI Pharma Services/Alcam

- Jubilant Life Sciences/Jubilant HollisterStier

- Specialist viral vector CDMOs (multiple fast-scaling firms)

- SK Pharmteco/Samyang/Dongkwang

- Peptide specialists & oligo CDMOs

- Lonza-scale smaller players & regional CMOs

Top Vendors in GMP Drug Substance Market & Their Offerings:

Lonza Group

Overview: Lonza is a leading global Contract Development and Manufacturing Organization (CDMO) specializing in biologics and small molecules.

Key Offerings:

- Biologics: Monoclonal antibodies, gene and cell therapies, and antibody-drug conjugates.

- Small Molecules: Active Pharmaceutical Ingredients (APIs) and intermediates.

- Services: End-to-end solutions from cell line development to commercial manufacturing.

WuXi AppTec

Overview: WuXi AppTec is a global platform offering comprehensive services for the discovery, development, and manufacturing of new therapeutics.

Key Offerings:

- Discovery Services: Medicinal chemistry, biology, and DMPK.

- Development Services: Formulation, analytical testing, and clinical trial material manufacturing.

- Manufacturing Services: GMP-compliant production of biologics and small molecules.

Samsung Biologics

Overview: Samsung Biologics is a leading CDMO providing integrated services for the biopharmaceutical industry.

Key Offerings:

- Cell Line Development: CHO-based platforms for high-yield production.

- Process Development: Scalable processes for biologics.

- Manufacturing: GMP-compliant production from clinical to commercial scale.

Fujifilm Diosynth Biotechnologies

Overview: Fujifilm Diosynth Biotechnologies is a global CDMO specializing in the development and manufacture of biologics.

Key Offerings:

- Cell Line Development: CHO and other mammalian cell lines.

- Process Development: Upstream and downstream process development.

- Manufacturing: GMP-compliant production of biologics and gene therapies.

Boehringer Ingelheim

Overview: Boehringer Ingelheim is a global pharmaceutical company offering contract manufacturing services for biologics and small molecules.

Key Offerings:

- Biologics: Monoclonal antibodies and biosimilars.

- Small Molecules: APIs and intermediates.

- Services: End-to-end solutions from development to commercial manufacturing.

Recipharm

Overview: Recipharm is a global CDMO providing development and manufacturing services for the pharmaceutical industry.

Key Offerings:

- Solid Dosage Forms: Tablets, capsules, and powders.

- Sterile Products: Injectables and ophthalmic solutions.

- Services: Formulation development, analytical testing, and GMP manufacturing.

MilliporeSigma

Overview: MilliporeSigma is the life science division of Merck KGaA, Darmstadt, Germany, offering a wide range of products and services for the pharmaceutical industry.

Key Offerings:

- Materials: Chemicals, reagents, and consumables.

- Services: Analytical testing, process development, and GMP manufacturing support.

- Technologies: Filtration, chromatography, and purification systems.

Segments Covered in The Report

By Modality/Drug Substance Type

- Small-molecule APIs

- Biologics monoclonal antibodies & recombinant proteins

- Viral vectors & other cell/gene therapy drug substances

- Oligonucleotides (ASO/siRNA)

- Peptides

- Vaccines & large immunogens

By Manufacturing Platform/Process Type

- Chemical Synthesis (small-molecule API routes)

- Mammalian cell culture (CHO/HEK for biologics)

- Microbial fermentation (E. coli, yeast)

- Viral-vector upstream/downstream platforms

- Cell-free/enzymatic & novel platforms

- Other (peptide synthesizers, peptide SPPS scale)

By Scale/Use Case

- Commercial-scale manufacturing

- Clinical-scale (Phase I–III) & tech transfer

By End User/Buyer Type

- Large pharmaceutical companies

- Biotech/Emerging developers

- Generics & biosimilar manufacturers

- CDMOs / internal toll/platform labs

- Academic & translational centers (GMP translation)

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

South America

- Brazil

- Argentina

- Rest of South America

Europe

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6311

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.